Introduction

As the global community increasingly recognizes the urgent need to address climate change, sustainable investing has risen to prominence. Green energy stocks represent one of the most compelling opportunities in this space, offering investors a chance to support the transition to renewable energy while potentially reaping significant financial rewards. This guide explores the landscape of green energy stocks, examining key companies, market trends, investment strategies, and the risks involved. Whether you are a seasoned investor or new to sustainable investing, this guide will provide you with a comprehensive understanding of how to navigate the green energy sector effectively.

What Are Green Energy Stocks?

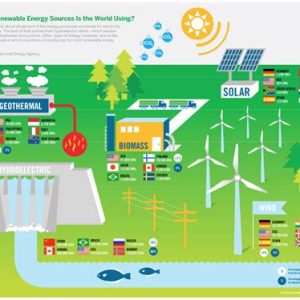

Green energy stocks are shares of companies that produce energy from renewable sources such as solar, wind, hydroelectric, geothermal, and emerging technologies like green hydrogen. These companies are integral to the global effort to reduce carbon emissions and combat climate change. Unlike traditional energy companies that rely on fossil fuels, green energy companies focus on sustainable and renewable energy production.

The main sectors within green energy include:

- Solar Energy: Companies like First Solar and SunPower specialize in solar technology, manufacturing solar panels and developing solar farms that harness the power of the sun.

- Wind Energy: Companies such as Vestas Wind Systems and Siemens Gamesa are leaders in wind turbine manufacturing, providing technology that converts wind into electricity.

- Hydroelectric Power: Brookfield Renewable Partners and Algonquin Power & Utilities are key players in the hydroelectric sector, which uses the energy of flowing water to generate electricity.

- Geothermal Energy: This involves tapping into the earth’s natural heat to produce energy, with companies like Ormat Technologies at the forefront.

- Green Hydrogen: An emerging sector with significant potential, companies like Plug Power and Ballard Power Systems are developing technology to produce and utilize hydrogen in an environmentally friendly way.

Investing in green energy stocks allows individuals to support companies that are working towards a sustainable future, making it an attractive option for those who wish to align their investments with their values.

Market Trends and Growth Potential

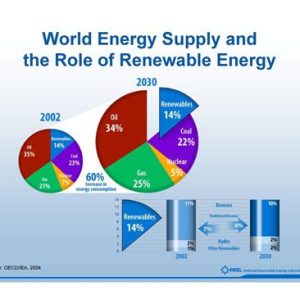

The green energy sector is experiencing unprecedented growth, driven by global efforts to transition away from fossil fuels. According to the International Energy Agency (IEA), renewable energy is expected to account for nearly 95% of the increase in global power capacity through 2026, with solar PV alone providing more than half of this growth.

Several factors contribute to this robust growth:

- Government Policies and Incentives: Many governments have set ambitious renewable energy targets and are offering subsidies, tax credits, and other incentives to boost the adoption of green technologies. For example, the United States has reintroduced and expanded tax credits for wind and solar energy under recent legislation, while the European Union has committed to making Europe the first climate-neutral continent by 2050.

- Technological Advancements: Continuous improvements in technology are making renewable energy more efficient and less costly. For instance, the cost of solar panels has decreased dramatically over the past decade, making solar power more accessible to businesses and homeowners.

- Corporate Sustainability Commitments: A growing number of corporations are pledging to reduce their carbon footprints by adopting renewable energy. Tech giants like Google, Apple, and Amazon have committed to powering their operations with 100% renewable energy, which drives further demand in the sector.

- Investor Interest: Sustainable investing is not just a trend; it’s becoming a mainstream strategy. ESG (Environmental, Social, and Governance) criteria are increasingly used by investors to evaluate companies, and green energy stocks often score highly on these metrics.

Despite these positive trends, investors must also be aware of the potential for market volatility, particularly due to regulatory changes, technological disruptions, or shifts in energy prices.

Risks and Considerations

Investing in green energy stocks is not without risks. Here are some key considerations:

- Market Volatility:

- Green energy stocks can be more volatile compared to traditional stocks due to factors like fluctuating energy prices, changes in government policies, and competition within the sector.

- Regulatory Risks: The green energy industry is heavily influenced by government regulations and incentives. Changes in policy, such as the reduction of subsidies for renewable energy projects, can have a significant impact on the profitability of companies within this sector.

- Technological Risks: While advancements in technology are driving the sector forward, there is also the risk that certain technologies may not perform as expected or become obsolete. For example, the rapid evolution of battery storage technology poses a challenge for companies that are slow to adapt.

- High Capital Costs: Many green energy projects require substantial upfront investments, which can be a barrier for some companies. While the costs of renewable energy technologies have been decreasing, the initial capital requirements for infrastructure development remain high.

- Competition: As the green energy sector grows, competition intensifies. New entrants are constantly emerging, and established companies must continuously innovate to maintain their market positions. This competitive landscape can impact profit margins and overall market share.

Investors should conduct thorough research and consider diversifying their portfolios to mitigate these risks. Understanding the specific challenges and opportunities associated with each type of green energy stock is crucial for making informed investment decisions.

Top Green Energy Stocks to Watch

The green energy sector is diverse, with numerous companies making significant contributions to renewable energy. Here are some of the top stocks to consider:

- NextEra Energy (NEE): As the world’s largest producer of wind and solar energy, NextEra Energy is a cornerstone of the green energy sector. The company has a long history of growth and innovation, and its commitment to sustainability is reflected in its business model, which focuses on expanding its renewable energy capacity.

- First Solar (FSLR): First Solar is a leader in solar technology, specializing in thin-film solar panels that are known for their efficiency and low environmental impact. The company’s focus on manufacturing in the U.S. also positions it well to benefit from domestic policies that favor local production.

- Vestas Wind Systems (VWS): Vestas is the world’s leading manufacturer of wind turbines, with a strong global presence and a reputation for innovation. The company’s extensive experience and focus on renewable energy make it a key player in the wind energy market.

- Brookfield Renewable Partners (BEP): Brookfield Renewable Partners owns a diverse portfolio of renewable energy assets, including hydroelectric, wind, and solar power. The company’s strategy of long-term investments in stable, high-quality assets makes it an attractive option for investors seeking steady returns.

- Plug Power (PLUG): A pioneer in the green hydrogen space, Plug Power is developing a range of hydrogen fuel cell solutions for various applications, including transportation and industrial use. The company’s innovative approach to hydrogen production and storage has positioned it at the forefront of this emerging market.

- Enphase Energy (ENPH): Specializing in solar microinverters, Enphase Energy provides technology that maximizes the efficiency of solar power systems. The company has experienced rapid growth as demand for solar energy continues to rise.

- Ormat Technologies (ORA): Ormat is a global leader in geothermal energy, providing a sustainable and reliable source of power. The company’s geothermal plants operate in multiple countries, and it continues to expand its capacity to meet growing demand for clean energy.

- Tesla (TSLA): Known primarily for its electric vehicles, Tesla is also a significant player in the renewable energy market through its solar energy products and energy storage solutions. Tesla’s integrated approach to clean energy solutions makes it a versatile player in the green energy sector.

How to Invest in Green Energy Stocks

Investing in green energy stocks can be an excellent way to align your financial goals with your environmental values. Here’s a step-by-step guide to get you started:

- Research and Identify Opportunities: Start by researching the different types of green energy stocks available. Consider factors such as the company’s market position, financial health, growth potential, and commitment to sustainability.

- Set Your Investment Goals: Determine what you want to achieve with your investment. Are you looking for long-term growth, dividend income, or a combination of both? Your goals will help guide your stock selection.

- Choose a Brokerage Platform: Select a brokerage that offers access to green energy stocks. Many online brokers provide tools and resources to help investors research and compare different stocks.

- Diversify Your Portfolio: Diversification is key to managing risk. Consider investing in a mix of green energy stocks across different industries and technologies. For example, you might invest in both solar and wind energy companies to spread your risk.

- Monitor Market Trends: Stay informed about market trends, news, and developments in the green energy sector. This will help you make strategic decisions and adjust your portfolio as needed.

- Consider ESG Funds: If you prefer a more hands-off approach, consider investing in ESG (Environmental, Social, and Governance) funds that focus on green energy companies. These funds are managed by professionals who select stocks based on their sustainability credentials.

- Be Patient and Stay Committed: Green energy is a long-term investment. Be prepared to hold your stocks for several years to maximize returns as the industry grows and evolves.

- Assess the Impact of Macroeconomic Factors: Green energy stocks can be influenced by broader economic factors such as changes in interest rates, inflation, and economic growth. Understanding these impacts can help you better navigate the market and adjust your investment strategy accordingly.

- Evaluate Company Leadership and Management: Strong leadership can be a critical factor in the success of a green energy company. Look for companies with experienced management teams that have a proven track record in the renewable energy sector.

- Explore Dividend Reinvestment Plans (DRIPs): Some green energy companies offer DRIPs, allowing investors to reinvest dividends into additional shares of stock, which can help grow your investment over time without additional capital outlay.

Impact of Green Energy on Global Sustainability

Investing in green energy stocks is not just about financial returns; it’s also about making a positive impact on the world. Renewable energy plays a crucial role in reducing greenhouse gas emissions, promoting energy independence, and supporting a sustainable future.

- Reducing Carbon Footprint: Renewable energy sources like wind, solar, and hydroelectric power generate electricity without emitting greenhouse gases. By investing in companies that produce clean energy, you are supporting the global effort to reduce carbon emissions and combat climate change.

- Promoting Energy Independence: Countries that invest in renewable energy can reduce their dependence on imported fossil fuels, enhancing energy security and economic stability. This shift towards energy independence is a key driver of global sustainability.

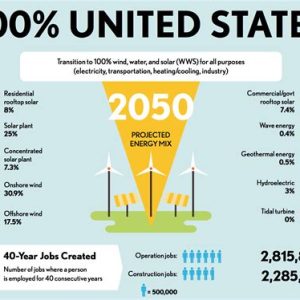

- Supporting Innovation and Job Creation: The green energy sector is a major source of innovation and job creation. As the industry grows, it drives economic development by creating new technologies and employment opportunities in manufacturing, installation, maintenance, and research.

- Contributing to a Healthier Environment: Renewable energy projects help reduce pollution, preserve natural resources, and protect biodiversity. For example, solar and wind farms require significantly less water than fossil fuel power plants, reducing strain on water resources.

- Building a Sustainable Future: By investing in green energy, you are helping to build a more sustainable future for generations to come. This commitment to sustainability extends beyond financial gains, aligning with a broader vision of environmental stewardship and social responsibility.

- Enhancing Community Resilience: Renewable energy projects often involve local communities, providing them with cleaner, cheaper, and more reliable sources of energy. This enhances community resilience, especially in remote or underserved areas where access to traditional power sources is limited.

- Accelerating the Energy Transition: Investment in green energy stocks supports the broader energy transition away from fossil fuels. This shift is critical to meeting global climate targets and ensuring a sustainable energy future.

Conclusion

Green energy stocks offer investors a unique opportunity to support the transition to a sustainable future while achieving their financial goals. With the right approach, green energy investments can provide significant returns, contribute to global sustainability efforts, and align with personal values. As the sector continues to grow and evolve, it presents numerous opportunities for investors willing to embrace the potential of renewable energy.

By understanding the market dynamics, risks, and opportunities, investors can make informed decisions and build a diversified portfolio that includes some of the leading companies in the green energy sector. Whether you are a seasoned investor or just starting, green energy stocks offer a compelling way to participate in the global shift towards sustainability.

FAQ

- What are green energy stocks?

- Green energy stocks are shares of companies that produce energy from renewable sources, such as solar, wind, and hydroelectric power. These companies focus on sustainable energy production, aiming to reduce carbon emissions and environmental impact.

- Are green energy stocks a good investment?

- Yes, green energy stocks can be a good investment, especially as the world moves towards more sustainable energy sources. They offer potential for growth and diversification, but like all investments, they come with risks such as market volatility and regulatory changes.

- Which companies are leading in green energy?

- Leading companies in the green energy sector include NextEra Energy, First Solar, Vestas Wind Systems, Brookfield Renewable Partners, and Plug Power. These companies are known for their innovation, market presence, and commitment to renewable energy.

- How do green energy stocks compare to traditional energy stocks?

- Green energy stocks often offer higher growth potential but can be more volatile compared to traditional energy stocks, which are typically more stable but have lower growth prospects. The performance of green energy stocks is closely tied to market demand, technological advancements, and government policies.

- What are the risks of investing in green energy stocks?

- Risks include market volatility, changes in government policies, technological disruptions, high capital costs, and increased competition. Investors should conduct thorough research and consider diversifying their portfolios to mitigate these risks.